The Cheapest and Most Profitable Energy Company You've Never Heard Of

More profitable than Apple. Faster growth than Meta. Cheaper than both. Meet the solar empire no one’s watching.

Simple Alpha breaks down the overlooked companies you’ll wish you found earlier — with the insights of an analyst and the energy of a founder. Join hundreds of contrarian thinkers.

"We are seeing the potential of renewables to become the low-cost provider of electricity. The economics are improving dramatically." Larry Fink, CEO of BlackRock

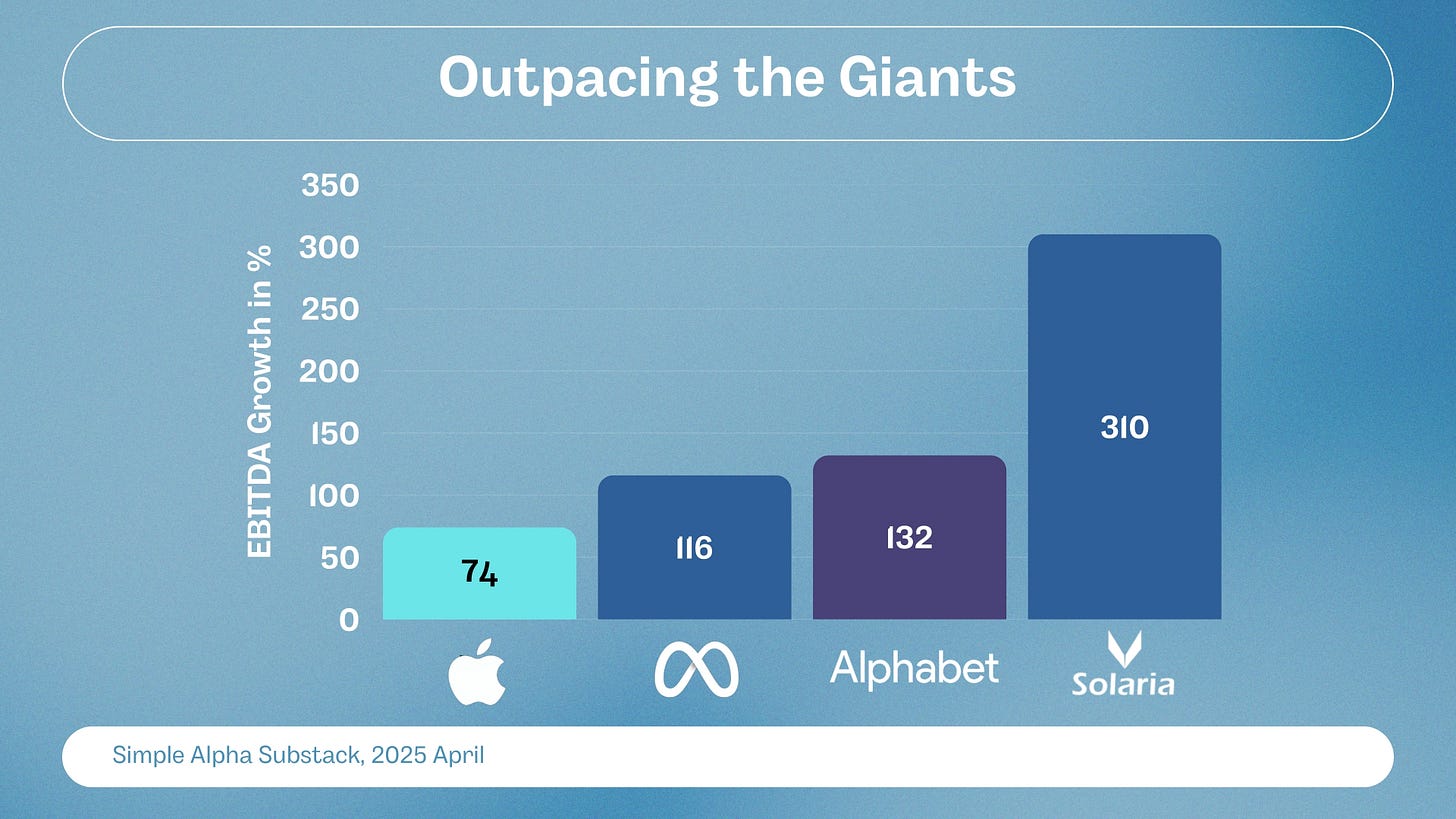

What if I told you there's a European company with higher net profit margins than Apple, Meta, or Alphabet? Now what if I also told you that its EBITDA has grown faster than all of them over the past four years — more than double their pace?

You’d probably think I was pitching the next AI chip startup out of San Francisco.

But here’s the kicker: this company’s stock is down 25% since 2020. Meanwhile, Big Tech has moonwalked their way up the charts. Oh, and this under-the-radar juggernaut still expects to grow double digits in 2025. This isn’t some stealth-mode unicorn or SPAC fever dream. It’s Solaria Energía — one of Europe’s biggest and most profitable solar developers.

This is the story of a company that's printing cash, growing fast, and somehow trading like it’s stuck in 2019. Let’s break it down.

So, how does Solaria make money?

Simple: they build solar and wind farms and sell electricity. That’s their bread and butter. But here’s where it gets interesting…

By the end of 2026, 11% of their energy will come from batteries they install next to their sites. Why does that matter?

Enter BESS — Battery Energy Storage Systems. Think of them as energy banks. They store power from solar, wind, or even the grid itself when electricity is cheap or oversupplied. Then they sell it back when prices spike — like during peak demand or when the sun isn’t shining.

The result? Fatter margins and smarter revenue. It’s not just about producing energy anymore — it’s about timing the market. Solaria gets it.

So, here is why I am bullish:

1) Energy Will Be the Bottleneck

The International Energy Agency (IEA) projects that global electricity demand will jump by at least 10% by 2030. That’s an extra 2,500 TWh per year — more than all of Europe consumes today.

Solar is already the cheapest energy source on the planet. In most markets, it’s at least 2x cheaper than coal or natural gas. While fossil fuel prices are expected to stagnate or rise (natural gas is currently trading above its 2010–2020 average), solar just keeps getting cheaper. In fact, the U.S. Department of Energy expects utility-scale solar prices to fall another 30% by 2030.

So if the world’s going to plug in more — to data centers, EVs, AI infrastructure — it won’t just want solar. It’ll need it.

2) Growth

Very few companies manage to grow this fast and this profitably. Solaria did both. In 2020, Solaria pulled in €49M in EBITDA. By 2025, they’re aiming for €250M — a 5x jump in just five years.

In 2024, they generated 2,543 GWh of clean electricity — enough to power 700,000+ households. And they’re not stopping there. By the end of 2026, they plan to double that output.

3) Profitability

Okay, so Solaria is profitable. But how profitable? In Q4 alone, they did €53M in revenue and walked away with €31M in net income. For 2024, total net profit? €89M — that’s a 59% net margin.

To put that in context: Even Meta, one of the most profitable tech giants on the planet, runs at 43%.

And 2025? Even if they miss their internal targets by ~5%, they’d still achieve €100M+ in net income. But why am I so confident that they won’t miss their targets? Because 35% of the construction needed to add 1.4 GW in new capacity for 2025 is already done.

This isn’t some maybe-if-the-market-likes-us story. It’s already being built — and banked.

4) Moat

What protects Solaria from a wave of new competitors? Two key things:

a) Land scarcity

b) Financing power

Let’s break it down.

There’s only so much land suitable for solar development — and it’s not something you can manufacture more of. That makes access to the right plots a strategic goldmine. Now layer in financing. Solar projects are capital intensive. But here’s where Solaria shines:

With a >20 year track record, they’ve built deep relationships with governments and know how to fast-track approvals.

They can use their existing energy assets as collateral to secure cheaper debt.

Case in point: their average cost of debt is just 3.7% — already low, and likely to drop further as rates come down.

In short: land is limited, money isn’t cheap, and Solaria has both. That’s a moat.

5) Valuation

We’ve covered the big three: growth, moat, and profitability. Now comes the kicker — valuation. Or in Buffett’s words: “Price is what you pay. Value is what you get.”

Right now, Solaria is trading at:

3.2x EBITDA

8x 2025 net income

Let that sink in.

For comparison:

Meta trades at 13x EBITDA

Apple? Around 20x EBITDA

And yet... both have lower growth and lower margins than Solaria.

If Solaria traded like a tech company, it’d trade >4x higher.

6) Skin in the Game: When the CEO Bets Big

Want to know who really believes in a company?

Follow the guy writing the checks and holding the chips.

Research shows that CEOs who buy and hold large stakes in their own companies outperform the market by >3% annually. Why? Because when your own money’s on the line, you make damn sure the ship stays afloat—and sails fast.

Now meet José Arturo Díaz-Tejeiro Larrañaga—Solaria’s CEO and full-time believer. He owns 35% of the company. Not stock options. Real shares.

But here’s where it gets spicy: In June 2022, while most investors were on the sidelines or heading for the exits, he bought 50,000 more shares at €21.62 each. That’s triple the current share price.

While everyone else was scared, he doubled down at all-time highs. That’s not just skin in the game—that’s soul in the game.

So, What’s the Catch?

No fairy tale comes without a dragon.

Solaria didn’t drop ~50% over the past two years for no reason. The villain? Falling energy prices. When electricity gets cheaper, so do Solaria’s revenues. Simple as that.

But energy prices are increasing: in January 2025, energy prices in Europe were 20% higher than the year before. In February, they spiked 136% YoY. Why?

A colder-than-expected winter in 2024 drained gas reserves

Germany got ghosted by the wind (again), forcing reliance on other, pricier sources

Global demand for energy continues to climb

So yes, if prices keep falling for an extended period, Solaria feels the heat. But as long as they keep adding capacity faster than prices drop, they stay ahead of the curve.

Now let’s talk interest rates.

Higher rates = higher borrowing costs = lower margins for infrastructure-heavy businesses like Solaria. But Europe’s inflation is cooling faster than a startup pitch after due diligence. In March, it dropped to 2.2%, getting cozy with the ECB’s target of 2%. Unless tariffs spike unexpectedly and cause another inflation wave in Europe (which seems rather unlikely), the trend points to lower interest rates—not higher.

And with the European economy forecasted to grow a healthy 1.5% in 2025, there’s no sign of overheating. Translation: the ECB isn’t slamming the brakes anytime soon.

Bottom line: yes, there are risks. But they’re measured, not monstrous. And for those who play the long game, they might just be the reason opportunity is mispriced.

Want full transparency? See exactly how my portfolio looks, track my month-to-month performance, and get all the insights—the good, the bad, and the ugly.

Join the paid subscription for €19.95/month. If you don’t make way more than that from my content, I’d be shocked. :)

Great post! On the EBITDA multiple, is there any particular reason why you are looking at Market Cap instead of EV? Current 11x (2025 not sure 8-10x with additional debt) anyway is the cheapest it has ever been.